Back in 2007, I asked a simple question about the diamond industry: Is Commoditisation Upon Us? Now, nearly 16 years later, I can confidently say that the answer is definitely yes, however, it is clear that both many members of the trade and the general diamond buying public do not see diamonds as a commodity.

Definition of a Commodity

Investopedia defines a commodity as:

“A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Commodities are most often used as inputs in the production of other goods or services. A commodity thus usually refers to a raw material used to manufacture finished goods. A product, on the other hand, is the finished good sold to consumers.”

Are Diamonds Now Commodities?

Based on the above definition, there are there are two factors in determining if something is a commodity. Firstly, it should be a raw material that is used to manufacture goods. Now despite the fact that when I refer to diamonds, I am referring to polished diamonds – not rough diamonds, polished diamonds are still considered raw materials when making jewellery, just like gold or platinum is alloyed and then cast or shaped into the piece of jewellery.

Secondly, a commodity should be interchangeable with other goods of the same type. Whilst not all polished diamonds are easily interchangeable for another of the same type, there are two main reasons for this. Firstly, the diamond is not GIA certified and secondly, the diamond has other issues, such as having inclusions visible to the naked eye or inclusions or fluorescence that causes haziness. Thus, rather than all polished diamonds being treated as a commodity, it can be said that high quality, GIA certified diamonds – the ones that any respectable jeweller sells are a commodity.

Secondly, a commodity should be interchangeable with other goods of the same type. Whilst not all polished diamonds are easily interchangeable for another of the same type, there are two main reasons for this. Firstly, the diamond is not GIA certified and secondly, the diamond has other issues, such as having inclusions visible to the naked eye or inclusions or fluorescence that causes haziness. Thus, rather than all polished diamonds being treated as a commodity, it can be said that high quality, GIA certified diamonds – the ones that any respectable jeweller sells are a commodity.

How are Diamonds Treated by the Trade and Consumers?

So in theory, diamonds are a commodity, but in practice, are they treated as such by the trade and consumers?

I would say the two biggest “pro-commoditisation” campaigners would be Martin Rapaport and Chaim Even Zohar. Both established the world’s biggest online wholesale diamond trading platforms – Rapnet and IDEX respectively, and both publish comprehensive data regarding diamond prices. Using these two platforms (and the myriad of others around), anyone in the industry can buy and sell diamonds – a bench jeweller who is a sole trader in Australia can buy from a large manufacturer in India and vice versa.

Above: Martin Rapaport – Diamond Tzar

However, as usual, with the diamond industry being old fashioned and fickle, things aren’t so simple. Firstly, a large proportion of the industry, both retail and wholesale still purchase diamonds using long credit terms, meaning diamonds are purchased based not on price or quality, but from whoever gives the best credit terms. Secondly, the industry has proven itself unable to handle the truth when it comes to diamond prices. This was manifested in March 2020 when Martin Rapaport dared to lower the prices on his list by an average of seven per cent, sparking an industry wide boycott of his services, and eventually leading Rapaport to suspend publication of his price list. It should be noted that stock markets around the world were down significantly more during this period, while crude oil tanked.

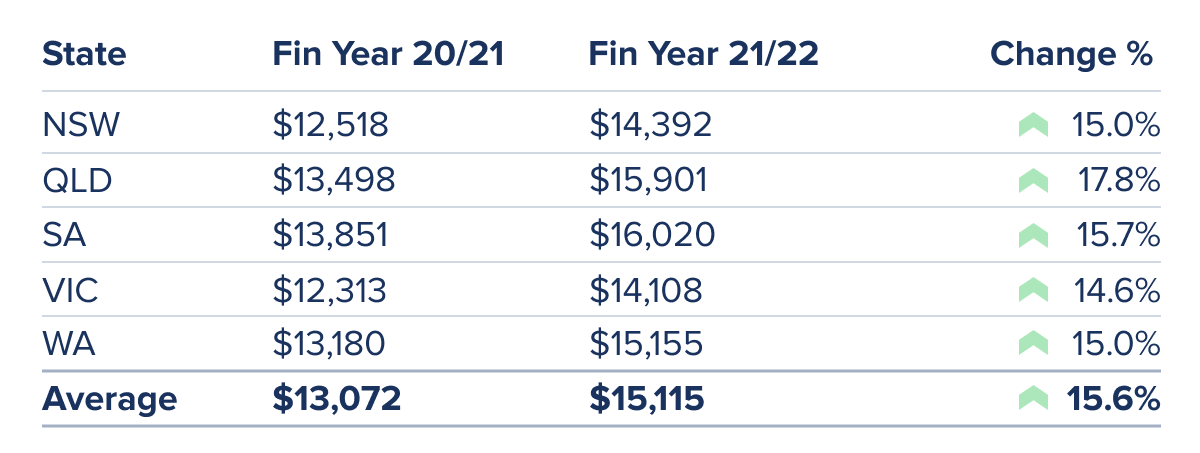

On the consumer side of things, consumers definitely don’t see diamonds as commodities, with the most diamond purchases still being made at brick and mortar stores. In fact, data from Q-Report shows both healthy retail margins and large fluctuations between Australian states, as shown below. This points to the fact that price alone isn’t the major factor driving consumer purchases, and retail jewellers can still charge whatever they want.

Above: Prices for a solitaire ring with a 1ct F/SI2 round diamond. Source: Q-Report.

Stupid Investment Schemes

Investing in diamonds is nothing new. However, my advice has always been that diamonds, whilst will generally hold their value and may increase in price, are a poor investment as there will always be higher yielding and less riskier investments available.

With diamonds now commodity, it hasn’t taken long for stupid investment schemes to pop up. One such scheme is Diamond Standard. Featured on CNBC, they use cheesy catch phrases such as “Invest Brilliantly™ in diamonds” and “Diversify with the hardest asset”.

Essentially, Diamond Standard promotes two products – a “coin” made up of 0.18 to 0.75 carat diamonds and a “bar”, which is made up of 0.76 to 2.05 carat diamonds. The “coin” and “bar” are purported to be fungible and thus able to be traded on Diamond Standard’s market.

There are two problems with this:

- The real value on a wholesale level of the diamonds that make up these “coins” and “bars” is unknown, thus any potential investor isn’t really investing in diamonds, but rather a “token” that is traded on Diamond Standard’s market.

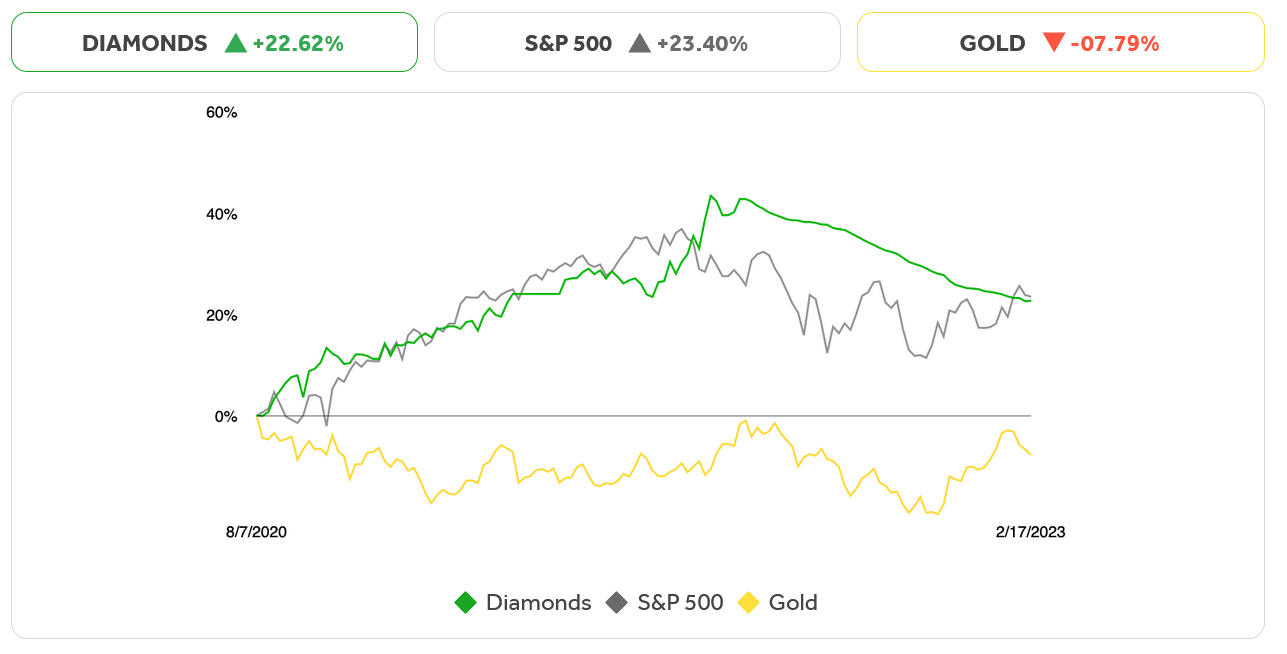

- The diamond prices they advertise simply do not align with the real world, as shown below.

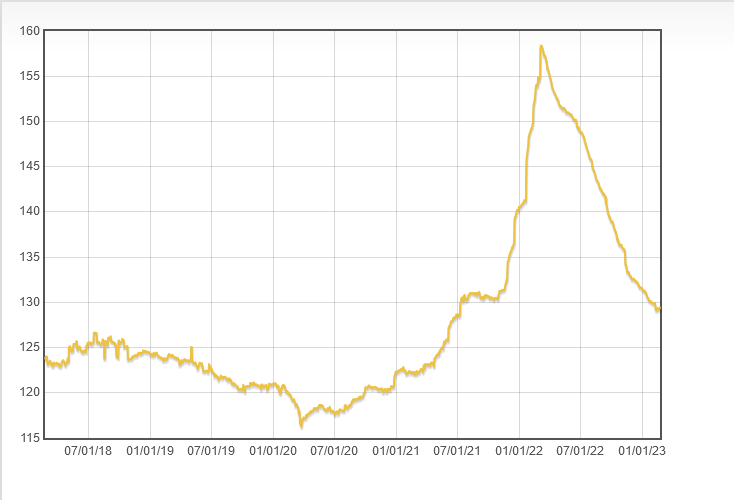

Above: Diamond Standard reporting prices rising 22.62% from August 2020 to February 2023. Meanwhile, IDEX reports a mere 10% increase, as shown below:

Thus, essentially, it looks like Diamond Standard, rather than a good, well thought out diamond investment scheme, it is merely a “diamond based bitcoin”.

Benefits and Drawbacks

The main benefit of diamonds becoming a commodity is, just like an commodity – price transparency and liquidity – that is the ability to determine a price and sell very easily.

However, with GIA being the de-facto authority, if their grading rules change, the impact on price can be massive. For example, as I wrote previously, GIA’s cut grading rules have changed over the years, leading to diamond “shrinkflation”.

Secondly, as Garry Holloway wrote all the way back in 2007, when diamonds become commodities, “Good new design and innovation are stymied.”