As another month goes by, diamonds, both natural and lab grown record another price drop. In natural diamonds, Rapaport records that 1ct round diamonds fell by 2.7% in the month of July alone, continuing their downward trajectory that started in March 2022. On the lab grown side, prices continue their predictable price slide with 1ct round brilliant, E/VVS2, ideal cut lab grown diamonds now available for well under A$700 including GST. However, the reasons for the price collapse of natural and lab grown diamonds are entirely different – one is supply driven and one is demand driven.

Lab Grown Diamond Prices

Lab grown diamond prices are quite the contradiction – demand is skyrocketing, but prices are falling at a breakneck speed. As Edahn Golan wrote in October 2022:

“The primary driver [of the price falls] is not a lack of demand or a decrease in the cost of production. It is the result of the action of one large grower.”

With more and more growers, who are becoming increasingly competitive, the supply of lab grown diamonds have exploded in the past year. This has led to prices going down dramatically – in the 70 to 90 percent range. Whilst there isn’t really any solid analytics on lab grown diamond prices available, anecdotally I am seeing price drops of 70% for 1ct lab grown diamonds, and even more for larger stones. For example, in early 2022, we were selling a 1ct round brilliant D/VVS2 for around A$2,000 including GST and now, in August 2023, we are selling a lab grown diamond with the same specifications for less than A$650 including GST.

Above: A lab grown diamond factory.

To complicate matters even more, the no one really knows how low lab grown diamond prices will go. Some in the industry, including myself, believe we are near a bottom in terms of lab grown prices, at least for the one to two carat range. However, others are not so optimistic, describing the current state of lab grown diamond prices as a “race to the bottom”.

Natural Diamond Prices

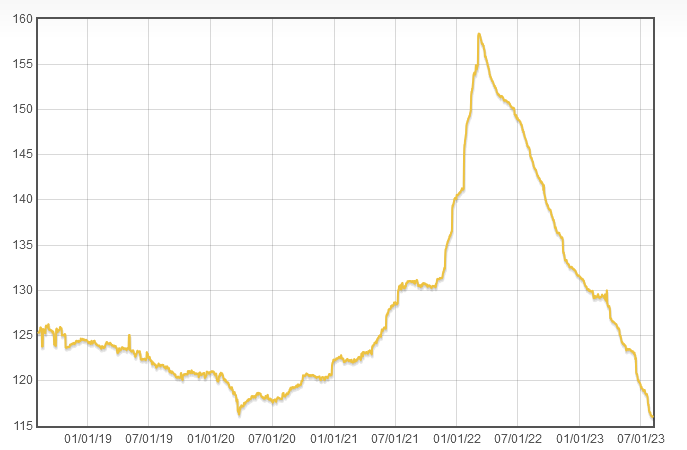

Amongst all the pandemic madness, natural diamonds recorded a slight dip in March 2020, but, from that point onwards, for the next two years till March 2022, recorded solid gains of 30 or more percent. However, since their peak in March 2022, natural diamond prices have been in steady decline, with the IDEX Diamond Index now dropping below pandemic lows.

Above: Five year graph of IDEX diamond prices.

However, unlike their lab grown counterparts, it is not because of increased supply, but due to decreased demand. Every man his dog seemingly has a reason for this decline in demand, such as:

- Diamond analyst Erez Jacob Rivlin asserts that consumers spending their money on travel instead of diamonds is to blame.

- Signet, the largest jewellery store chain in America, claims that the pandemic prevented people from meeting their future partners, thus cutting demand for engagement rings.

- Of course, the elephant in the room is the competition presented by lab grown diamonds. As Edhan Golan writes, by now lab grown diamonds most likely outnumber the natural diamonds in the amount of units sold.

- Rising inflation and interest rate rises that weaken consumer demand, especially for luxury goods.

Will Natural Diamond Prices Recover?

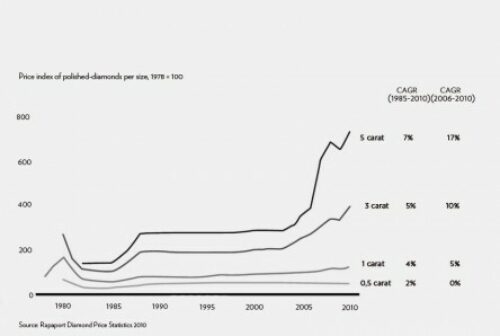

There have always been boom-bust cycles in natural diamonds. Most of the time, they have followed macroeconomic trends, other times, they have been fuelled by speculation.

For example, in the late 1970s and early 1980s, diamond prices skyrocketed, fuelled purely by speculation. For example, a one carat D colour, flawless round brilliant fetched around US$70,000 at the height of the bubble. However, as The LA Times writes:

“From 1981, real interest rates went through the roof, the dollar soared and inflation tumbled. The bubble burst and overextended speculators scrambled to sell their diamonds.”

Above: Chart showing a sharp decline of diamond prices in the early 1980s

However, during the “great recession” that started in 2008, diamond prices peaked in mid-2008, before collapsing, almost overnight in November 2008, fuelled by widespread bank collapses and a sharp increase in unemployment.

Whilst I’m no diamond price analyst, it seems the current boom-bust cycle is a combination of both dealer speculation and macroeconomic conditions. In fact, I think, faced with almost zero percent interest rates and uncertainty for two years, a lot of people speculated with a lot of different assets – not just diamonds. Now, with a sharp increase in inflation and therefore interest rates, both consumer demand for diamonds has weakened and speculation has albeit disappeared, leading to the price drops we are seeing today.

What is different about past boom-bust cycles is that now the natural diamond industry has a real competitor in lab grown diamonds. In addition to this, unlike in the 1980s, supply isn’t controlled by one organisation, De Beers, thus it is not simply a matter of turning off the supply tap. Therefore, whilst it seems we are near the bottom in terms of natural diamond prices, they may well have further to fall.

Good News for Consumers

Far from being pessimistic, I think lower diamond prices, whilst not financially good for Jogia Diamonds and the diamond industry as a whole, are great news for consumers.

With lab grown diamonds, we are seeing a whole new market open up, with consumers now able to design and buy jewellery that was simply price prohibitive with natural diamonds – whether it be tennis bracelets, diamond earrings or diamond solitaire rings.

In terms of natural diamonds, I am seeing prices for diamonds below two carat at prices I’ve never seen before in my 17 years in the industry. Whilst some retailers and wholesalers are reluctant to lower their prices, my advice to anyone looking to buy a natural diamond would be to shop around, as some retailers will be pricing their stock at last year’s prices, whilst others will be able to offer prices based on current international prices, like we do with our International Selection.