As the shine begins to tarnish on the lab grown diamond trade due to price falls and consumers getting wiser as to the real value of lab grown diamonds, now is a good time to reflect on the lessons learned from the past three or four years that has transformed the diamond industry.

Deflation Isn’t A Bad Thing

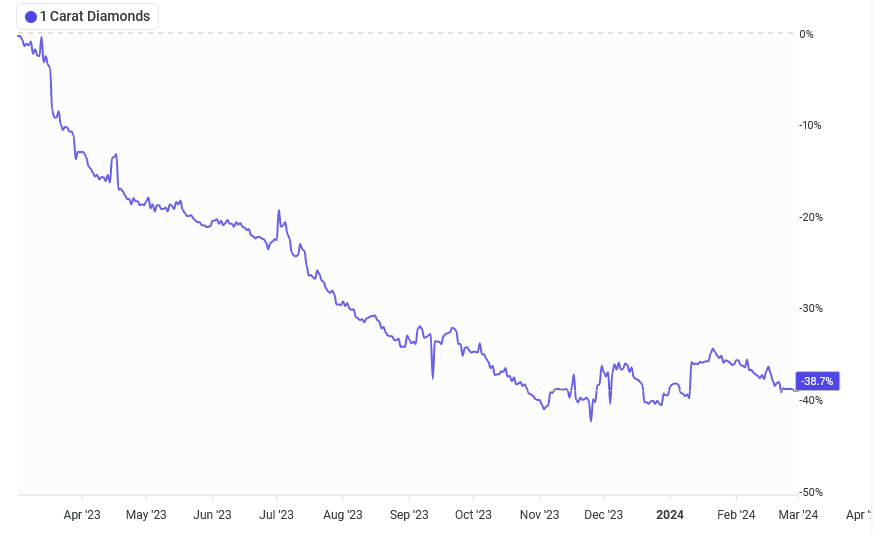

Traditionally, most economists say that deflation is generally a bad thing, due to the fact that consumers will delay spending if they expect prices to come down in the near future. However, as I have written m any times before, lab grown prices have been decimated in the past three years. For example, a 1ct round E/VVS2 lab grown diamond retailed for around A$2,000 in early 2022. Just two years later, the same diamond retails for just over A$500 – a drop of nearly 75 percent. However, the popularity of lab grown diamonds continues to grow and shows no signs of abating.

Above: 1ct lab grown prices from March 2023 to March 2024. Source.

The real losers from this rampant price deflation are not consumers who bought at a higher price, as consumers generally buy jewellery for their own enjoyment – not as an investment. Moreover, the real losers are the businesses that have invested heavily in lab grown diamonds, who have seen the value of their inventory fall dramatically, as well as businesses who have chosen to base their entire existence on lab grown diamonds, who must now decide whether or not they want to compete in the low-end and fashion jewellery market or pivot toward more precious gemstones, which, dare I say, may well be natural diamonds.

China Doesn’t Have An Off Switch

According to CGTN, half of the world’s lab grown diamonds are produced in Henan province in China. This, combined with another manufacturing powerhouse that is India, and supply of lab grown diamonds has sky-rocketed, which is the primary reason for the fall in prices.

Above: China’s Car Graveyard.

The fact is, that this situation is not unique to lab grown diamonds, as China is notorious for over producing everything from houses to cars. With seemingly endless supply from China and India, and with production costs going down, expect the value of lab grown diamonds to plummet even further.

If Others Trash Your Product You Need to Fight Back

One of the main selling points from die-hard lab grown diamond proponents are that they are “eco-friendly” and “ethical” when compared with the natural counterpart. Anecdotally, these claims seem to have stuck with consumers, although I am almost certain that price is the major factor when deciding between natural and lab grown diamonds.

Despite most of these claims being easily debunked, the organisation set up by diamond miners themselves to promote natural diamonds, The Natural Diamond Council (NDC), have been virtually silent on this issue. The only instance I can think of where they have shown any fight was to write an open letter to the BBC in response to a Dragons’ Den episode. However, what the NDC should have done was to fight back, potentially with lawsuits against companies that promote these “greenwashing” claims. Back in the late 90s and throughout the 2000s, record and movie industry groups filed lawsuits, many against individuals, in order to combat the growth of online piracy. Whilst I am not advocating a similar campaign from the NDC, I do think they should have shown some fight, which would have garnered a lot more media attention than simply setting up a website promoting natural diamonds.

Above: In the Early 2000s, the RIAA and MPAA Fought Back Against Online Pirates.

The Trade Must View The World From A Different Perspective

Most in the diamond and jewellery trade view the world through rose coloured glasses. Chief amongst them is Martin Rapaport, who views an engagement ring with natural diamonds as one of the most important parts of a marriage. This is entirely understandable, as many in the trade have been working their entire lives, and some have even grown up in the diamond and jewellery industry.

Above: Diamond Tzar Martin Rapaport.

However, in reality, the world does not function the way pundits like Martin Rapaport want it to function. Engagement rings may be seen as just another wedding expense by some couples. Other couples may choose not to get married at all. Furthermore, many of the wealthiest in society don’t wear expensive jewellery at all, instead, opting to wear heirloom pieces or inexpensive jewellery with nice aesthetics.

Natural Diamonds are a Valuable Commodity

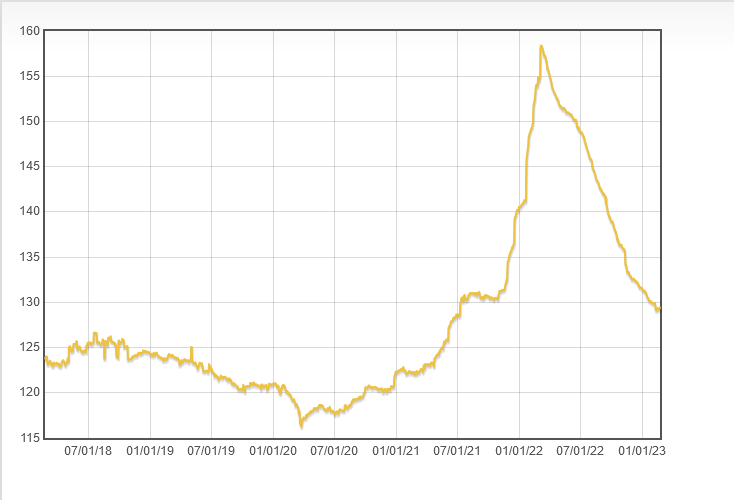

Despite natural diamond prices having fallen over 30 percent from their highs in 2022, they are still just 10 percent down on their 2019 prices, despite demand collapsing and new competition posed by lab grown diamonds.

Above: Diamond Prices from 2018-2023

One commonly held belief is that diamonds are only valuable due to De Beers’ being a monopoly, combined with a marketing campaign in the mid-20th century. However, given the current fragmented state of the natural diamond market and lab grown diamonds posing huge competition, it is clear that such assumptions are not true at all. In fact, natural diamonds are behaving like any other commodity, and as such should be treated as such – something I have been advocating for many years, but the jewellery industry, in an effort to protect retail margins push back against.

Natural diamonds have, and most likely will continue to dominate the engagement ring market, having dealt with the biggest threat to their dominance in nearly 100 years. However, it will soon be time for the natural diamond industry to deal with ongoing issues, such as those relating to provenance, as well as reversing the seemingly terminal decline in prices, which will in turn bring confidence back to the market, both within the industry and with consumers.